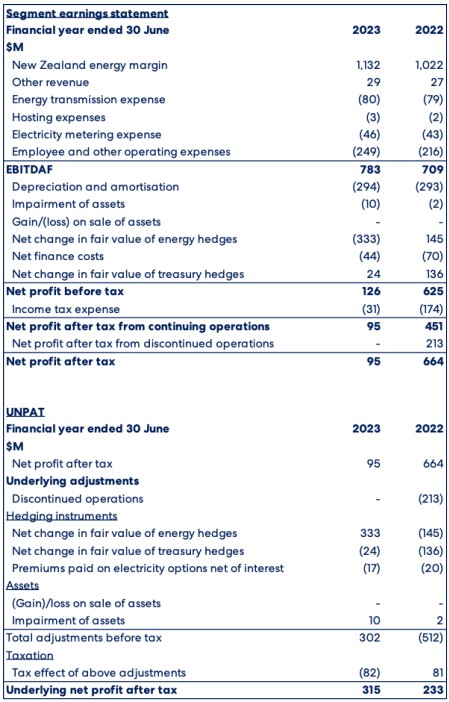

Meridian Energy has reported net profit after tax of $95 million for the year ended 30 June 2023, down from $664 million reported last year, which included the gain on the sale of Meridian's Australian business and positive non-cash movements in the value of hedge instruments.

Excluding the gain on sale and non-cash movements in hedge instruments, underlying net profit after tax[1] was up 35% to $315 million and operating earnings or EBITDAF[2], was up 10% to $783 million for the year ended 30 June 2023. This improved operating result was driven by higher customer sales, higher generation volumes and positive wholesale trading results.

“We’ve continued to focus on playing a key role in helping Aotearoa New Zealand to decarbonise by driving forward with our renewable developments and offering customers an enhanced range of clean energy solutions,” says Chief Executive Neal Barclay.

“I’m particularly proud that Meridian is leading the market in being the first New Zealand company to progress a grid-scale battery construction in this country, which will add significantly more flexibility to the electricity system in the form of energy storage. We have also secured credible and committed partners to advance the Southern Green Hydrogen project. We see this as a potential game changer as it will support Aotearoa’s drive to energy independence by providing significant demand response and an energy source for hard to abate processes.”

The Board declared a final ordinary dividend of 11.90 cents per share, 3% higher than the previous year. This brings the total ordinary dividends declared for the year to 17.90 cents per share, also 3% higher than the previous year.

Our annual report for FY23 can be found here.

Customers

Meridian grew overall sales volumes by 2.6%, while also increasing focus on creating more meaningful relationships with customers to support their decarbonisation opportunities.

The company has made good progress expanding the Zero electric vehicle charging network, as well as electric vehicle and solar customer participation. Meridian is also supporting customers with both process heat conversion and demand flexibility volumes, which is building on the 50MW demand response agreement reached with New Zealand’s Aluminum Smelter, announced in June, and supports our low carbon hedge portfolio.

This month, Powershop won Consumer New Zealand’s People’s Choice award for the third year in a row, and the sixth time since 2015.

During the year, Meridian completed the migration of the Meridian customers to the Flux customer care and billing platform. All Meridian customers are now on this world-class platform that will enable the business to continue to deliver great customer service and innovative products in a rapidly evolving competitive environment. The company also expects to continue to reduce the cost to serve its customers.

Meridian’s Energy Wellbeing program, launched during the year, continued to support the company’s most vulnerable customers.

“An initial trial provided support for 250 households, and we found that by being a conduit into social support agencies and by applying our own capabilities we were able to help these customers with energy affordability challenges,” says Barclay.

“We are now ramping up the program and targeting $5 million into a new Energy Wellbeing Fund to support families in energy hardship with the aim of reaching 5,000 households by the end of 2024.”

Renewable energy growth

Meridian continued to invest strongly in its pipeline of new renewable development. The company has doubled its pipeline of potential projects to 4.7GW (11.1 TWh), with 1.5GW of that capacity secured and 3.2GW in advanced prospects.

“The sector is experiencing a growth phase greater than at any other time in New Zealand’s history. Competition is strong, and we’re confident the sector will drive the best outcomes at the least cost for New Zealanders. For Meridian to do our share of the heavy lifting, we’ll need to build the equivalent of 20 large wind farms by 2050,” says Barclay.

Meridian’s Harapaki wind farm, currently being built in the Hawke’s Bay, was in the eye of Cyclone Gabrielle and suffered damage to the site, with repairs putting the project back three months. First power is now expected during October this year.

“Our team did an amazing job effecting repairs, as did Unison, Transpower and Waka Kotahi in repairing the local grid and roading to the site. The project is back in full swing and it will be powering the equivalent of 70,000 households by September 2024,” says Barclay.

“I am immensely proud of the Meridian team who were quick to support rescue services and became first responders to some of the victims directly affected by the cyclone in those first days and weeks.”

As part of Meridian’s Ruakākā Energy Park development, near Whangārei, the company has started construction on a grid-scale Battery Energy Storage System (BESS) and has also lodged consent applications for the 300GWh Mt Munro wind farm in the Wairarapa. Consent for a grid scale solar farm, also at the Ruakākā Energy Park, is imminent.

Waitaki Reconsenting

Meridian recently submitted a reconsenting application to secure the generation outputs from the portion of the Waitaki Power Scheme that it owns and operates for a further 35 years. The existing consent conditions expire in April 2025.

“The flexibility that the Waitaki Power Scheme provides will play a key role in how New Zealand can help combat the impacts of climate change over the next 35 years and beyond through continued electrification and by enabling the further growth of intermittent wind and solar electricity,” says Barclay.

“The reconsenting process still needs to run its course, but by ensuring we have strong endorsement and support from the key parties in the region we can be confident of a positive outcome.”

Sustainability

As the largest 100% renewable energy company in Aotearoa New Zealand, sustainability has always been core to who Meridian is and how we operate. From the material actions to the small details, Meridian continues to step up to the challenge of leading where it counts to support New Zealanders’ transition to net-zero by 2050.

Meridian’s sustainability efforts were once again recognised this year, with the company named in the Kantar Better Futures Report as one of New Zealand’s most sustainable businesses.

“Our Half by 30 roadmap and Climate Action Plan are our blueprint beyond net carbon zero to a substantially reduced future emissions footprint. Our 100% emissions offset has been expanded to now include one-off construction emissions from renewable energy generation projects. By 2030 our Forever Forests planting programme, will be removing the same amount of emissions that we produce, and we remain on track to have 700,000 trees in the ground by next financial year,” says Barclay.

This year Meridian has significantly increased support to Aotearoa’s longest-running conservation programme (Project River Recovery), and as part of reconsenting mitigation, has begun to work more closely with local rūnaka to improve cultural and social impacts for mana whenua in the country’s largest hydro catchment – the Waitaki. With Meridian’s biodiversity commitment published this year, development will continue on what a meaningful contribution will look like into the future.

[1]Net profit after tax adjusted for the effects of changes in fair value of unrealised hedges, electricity option premiums and other non-cash items and their tax effects. Underlying net profit after tax is a non-GAAP financial measure. Because they are not defined by GAAP or IFRS, Meridian’s calculation of such measures may differ from similarly titled measures presented by other companies and they should not be considered in isolation from, or construed as an alternative to, other financial measures determined in accordance with GAAP. Although Meridian believes they provide useful information in measuring the financial performance and condition of Meridian’s business, readers are cautioned not to place undue reliance on these non-GAAP financial measures. A reconciliation of underlying net profit after tax is included on page 4.

[2]Earnings before interest, tax, depreciation, amortisation, unrealised changes in fair value of hedges, impairments and gains or losses on sale of assets. EBITDAF is a non-GAAP financial measure but is commonly used within the electricity industry as a measure of performance as it shows the level of earnings before impact of gearing levels and non-cash charges such as depreciation and amortisation. Market analysts use the measure as an input into company valuation and valuation metrics used to assess relative value and performance of companies across the sector.