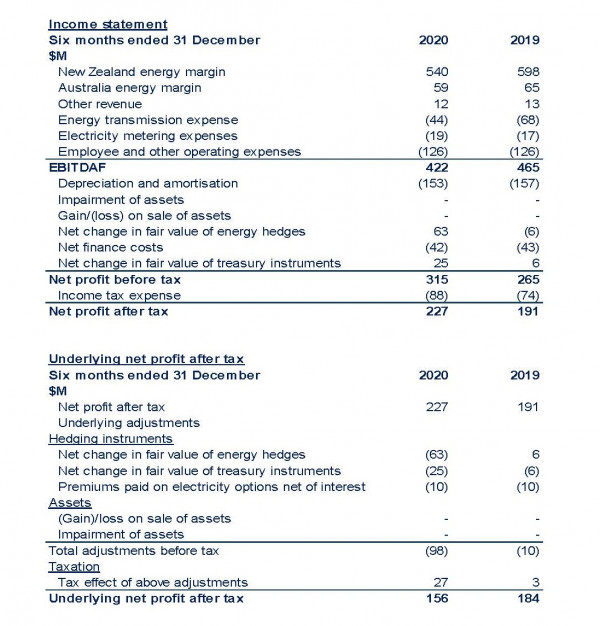

Meridian Energy has reported a 19% increase in net profit for the six months ended 31 December 2020, which includes positive changes in the value of hedge instruments. Excluding these hedge value movements, Meridian has reported a 9% decrease in its EBITDAF1. Customer growth continued, however lower New Zealand hydro generation and lower market prices in Australia negatively impacted EBITDAF from last year’s record level.

Chief Executive Neal Barclay says Meridian’s performance partly reflected less than favourable conditions compared to the prior year. Overall, our generation volumes were down 7% on the prior period due to lower starting storage and lower inflows into our catchments since October 2020.

Generation volume and price volatility are a feature of New Zealand’s hydro-based renewable electricity system; however the underlying performance of the business remains strong and we were particularly pleased that the strength of the Meridian and Powershop brands continued to shine through.

“Customer numbers across New Zealand and Australia now exceed half a million and have grown 3% since June 2020. It is pleasing to see continued customer growth, demonstrating that our commitment to excellent service and support is delivering,” Mr Barclay says.

Meridian announced in January 2021, that it had reached an agreement with its largest customer, Rio Tinto. Rio Tinto, who operate the Tiwai Point Aluminium Smelter in Southland will extend the planned closure period from August 2021 to December 2024.

“The additional four years of smelter operation will be invaluable to the Southland region as it allows time to create new business opportunities and new jobs for Southlanders. Meridian is committed to working with a range of parties who are progressing some exciting new opportunities in Southland, from mega scale data centres to hydrogen production at scale. The availability of large amounts of renewable energy in Southland is a point of difference for the region and our country,” says Barclay.

“As a 100% renewable energy generator who is committed to protecting our environment, we’re supportive of the Climate Change Commission’s advice. We believe that the electricity sector is a huge part of the solution to decarbonise our economy and support New Zealand businesses and individuals to make the changes they need. Our decision to build the new Harapaki wind farm is our

next step towards that solution.

“We know that we will play a part in supporting our customers, from large businesses who need to invest in technology and transition from fossil fuels, to every day New Zealanders. Everyone in our country has the opportunity to prosper and thrive as we lock in net zero by 2050,” says Barclay.

* EBITDAF is a commonly used non-GAAP measure reflecting earnings before interest, tax, depreciation, changes in fair value of hedges and other significant items (see page 2 for a reconciliation).

ENDS

Neal Barclay

Chief Executive

Meridian Energy Limited

| For investor relations queries, please contact: Owen Hackston Investor Relations Manager 021 246 4772 |

For media queries, please contact: Meridian Energy Media Team 0800 948 843 MediaTeam@meridianenergy.co.nz |