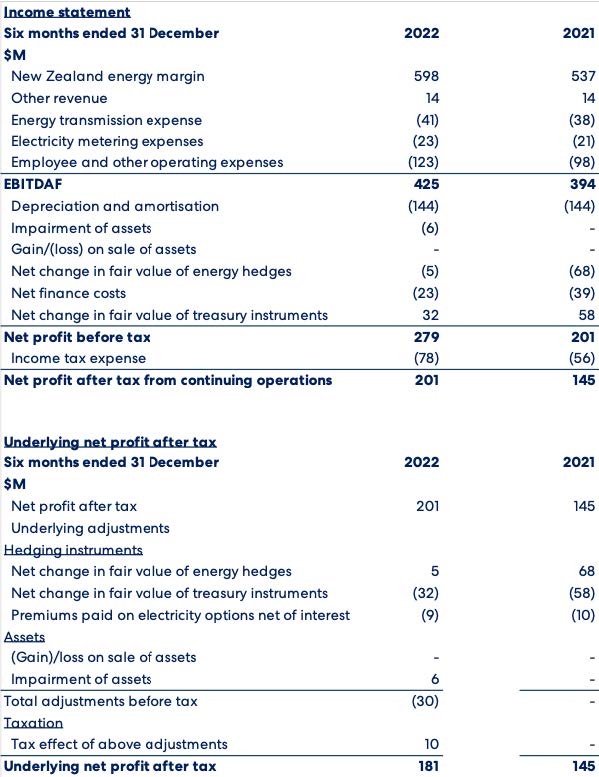

Meridian Energy has reported net profit after tax of $201 million for the six months ended 31 December 2022, $56 million (39%) higher than the same period last year. Included in the result is an unrealised gain in the value of hedge instruments amounting to $27 million (compared with a loss last year of $10 million) and a $16 million reduction in finance costs due to the retirement of debt following the sale of Meridian’s Australian subsidiary during January 2022. Meridian’s operating earnings from continuing operations (EBITDAF[1]) increased by $31 million (8%) over the prior period.

Chief Executive Neal Barclay says Meridian’s strong first half operating performance reflected favourable hydrology, with better than average inflows into the hydro catchments we manage and continued good growth in the amount of energy sold to our retail customers. Customer sales volumes were up by 5% on the prior year. Operating earnings also benefited from $51 million of electricity hedge close outs.

Meridian started the financial year with below average storage in Lake Pukaki, however this situation changed during July and August 2022 when a series of large storms lifted storage significantly. Meridian winter 2022 inflows into its Waitaki catchment were the highest winter inflows on record.

During this reporting period Meridian more than doubled the size of its renewable development pipeline of buildable options to 11,100 GWh. “We have a bold vision for our renewable pipeline, and we intend to continue to push hard and grow our renewable generation assets at pace,” says Barclay.

In December 2022, Meridian announced that it will begin construction of the $186 million Ruakākā Battery Energy Storage System, New Zealand’s first large-scale grid battery storage system, situated south of Whangārei.

“The battery has a 200 MWh capacity and will make a significant contribution to the reliability of the overall electricity grid allowing more intermittent wind and solar renewable electricity generation to be efficiently accommodated within the system. And to that point, we’re also preparing to lodge consent applications for a new wind farm at Mount Munro in the Wairarapa and a 130MW solar farm, also at Ruakākā, both in the middle of 2023. We’re getting on with it,” adds Barclay.

Meridian’s Harapaki wind farm, currently under construction in Hawkes Bay largely escaped direct impacts from Cyclone Gabrielle, and we are working through access and resourcing challenges at site.

“Our thoughts go out to those suffering in the devastation Cyclone Gabrielle has wreaked.” Barclay says.

“We’ve copped two extremely wet summer construction seasons in a row and our team have done a remarkable job keeping the project on schedule.” Barclay says.

During the last year, Meridian trialled a new Energy Wellbeing Programme directed at supporting customers experiencing hardship and the company intends to scale up this approach during 2023.

“Our team are enthused by the tangible difference we’ve been able to make for Kiwi families who are struggling. And working with Government and other social agencies, we believe we can reach up to 5,000 households with targeted support to do our part to help keep their homes warm and dry in winter.”

Meridian’s Process Heat Electrification programme has earmarked up to 600 gigawatt hours per annum, helping large industrial customers switch from coal or gas to electricity. This will prevent 300,000 tonnes of CO2 being pumped into the atmosphere, the equivalent of removing around 150,000 cars off Aotearoa’s roads.

Prior to Christmas, Meridian, with the support of Ngāi Tahu, announced it had selected Woodside Energy (Woodside) as the preferred partner to move forward to the development stage of the proposed Southern Green Hydrogen project in Southland. Mitsui & Co., Ltd. (Mitsui) is also in discussions to join the project and develop the potential export markets for SGH’s Green hydrogen-based products.

“We believe a large-scale green hydrogen facility, focusing initially on the export market, will help accelerate the development of a new hydrogen economy at home and strengthen New Zealand’s ability to decarbonise our transport and industrial sectors,” says Barclay.

“Our aim is to create a world-class collaboration that covers the full green hydrogen and ammonia supply chain and add jobs and a new industry to Aotearoa’s domestic economy.”

[1] EBITDAF is a non-GAAP financial measure of earnings before interest, tax, depreciation, amortisation, changes in fair value of hedges and other significant items