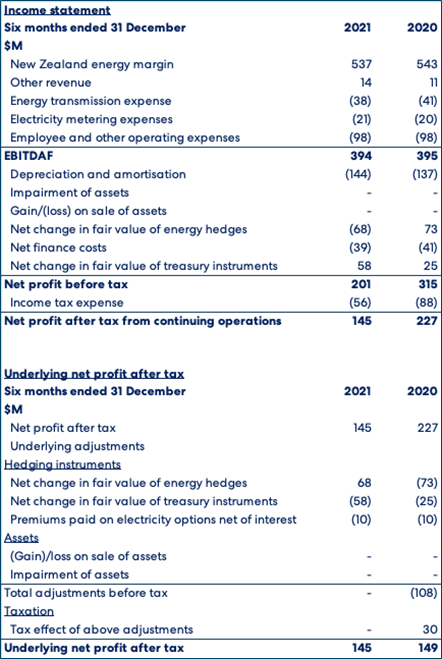

Meridian Energy has reported net profit after tax of $145 million from continuing operations for the six months ended 31 December 2021, $82 million (36%) lower than the same period last year, mainly reflecting negative changes in the value of hedge instruments. Excluding these hedge value movements, Meridian reported a $1 million decrease in EBITDAF[1] and a $5 million decrease in underlying net profit after tax [2].

Meridian’s Board has declared an interim ordinary dividend of 5.85 cents per share, 2.6% higher than for the same period last year. The company’s Dividend Reinvestment Plan will apply to this year’s interim dividend, at no discount to the average market price over a five-day period ending on 23 March 2022. The interim dividend will be paid, and new shares issued under the reinvestment plan on 8 April 2022.

Meridian’s Chief Executive Neal Barclay says that operating performance in the first half of this financial year includes a reduction in revenue received from the Tiwai Point Aluminium Smelter, so the on-par performance with last year reflects continued strong momentum in the company’s operating business.

“It’s pleasing to see continued growth in retail sales, which reflects an enduring commitment to excellent customer service and support. Our retail performance has helped offset the impact of NZAS exit pricing, and we’re making sound progress on our strategy to develop new sources of South Island demand following the Tiwai contract end in 2024,” Mr Barclay says.

Meridian completed the sale of MEA (which includes Powershop Australia) on 31 January 2022. The final sale price was A$740 million including interest and intercompany funding movements since 1 July 2021. With completion of the MEA sale having occurred on 31 January 2022, Meridian’s investment in MEA has been classified as held for sale and a discontinued operation at 31 December 2021. Meridian expects to recognise a gain on sale in the order of $240 million in its full year accounts for 2022.

“This transaction is an outstanding result for Meridian’s shareholders and a testament to the quality of the Meridian Energy Australia business and the employees who have been dedicated to its success,” says Mr Barclay.

Meridian has commenced bulk earthworks at its Harapaki wind farm development in Hawke’s Bay and has been actively working to increase its renewable development pipeline. This includes the company’s November 2021 announcement of the development of Ruākākā Energy Park. This project will house a battery energy storage system (BESS) at least 100MW in capacity, as well as a utility-scale solar farm.

Four potential partners have been selected for the next phase of the Southern Green Hydrogen project, a joint venture between Meridian Energy and Contact Energy to investigate the feasibility of developing the world’s first large-scale green hydrogen plant in Southland.

A process is now underway to assess proposals from each of the four counterparties to develop the production and export facility in Southland.

“We’re excited to move forward with the RFP and bring the project closer to fruition,” adds Mr Barclay.

The electricity sector has been the focus of a number of regulatory reviews, including the Electricity Authority’s Wholesale Market Review and reviews of the 9 August 2021 power outages.

“While we have some concerns with some of the preliminary findings from the Electricity Authority’s most recent Wholesale Market Review, there is no doubt that as an industry we need to move faster to help New Zealand achieve its climate goals. We always support ways that the sector can provide better outcomes to consumers, and we’re committed to working with the sector, businesses, government, and consumers to ensure we achieve these goals.”

[1] EBITDAF is a commonly used non-GAAP measure reflecting earnings before interest, tax, depreciation, changes in fair value of hedges and other significant items. [2] Net profit after tax adjusted for the effects of non-cash fair value movements and other one-off items.

ENDS

Neal Barclay

Chief Executive

Meridian Energy Limited

| For investor relations queries, please contact: Owen Hackston Investor Relations Manager 021 246 4772 |

For media queries, please contact: Meridian Energy Media Team 0800 948 843 MediaTeam@meridianenergy.co.nz |